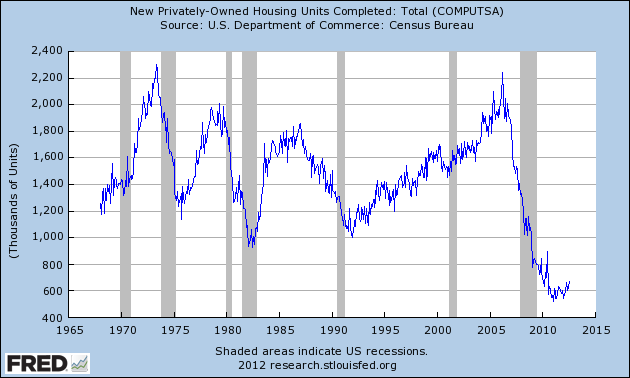

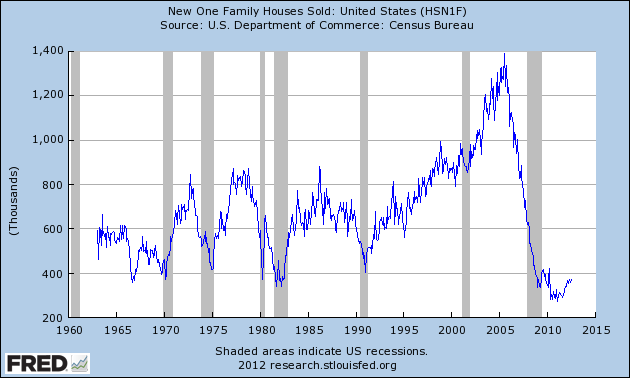

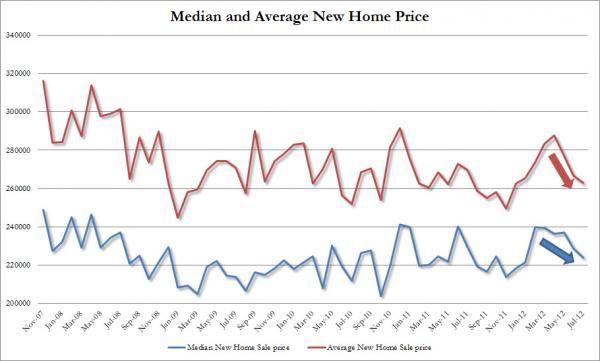

?First of all, you need to put the "improved numbers" into perspective. Consider home building, single family home sales, and new home prices.

? While it isn't getting any worse, it's still not a pretty picture.

But then housing is supposedly not a short-term investment (except when it was a short-term investment just a few years back). You are in for the long-haul, right?

? ?That means younger, future buyers are key.

Well, maybe not the 48% of young homeowners that are underwater.

The state of finance

? ?The biggest, and least acknowledged, factor in real estate today is the condition of the GSE's - Fannie Mae and Freddie Mac.

? ?You might remember them for the $188 Billion taxpayer bailout that followed their collapse in 2008 (and only ended a few quarters ago).

? ?You might also be familiar that they were an important part of owning millions of foreclosed homes. Well, that legacy continues today.

?Only half of the previously foreclosed homes owned by Fannie Mae are either on the market or being prepared for sale. The remaining properties are currently locked away in some step of the foreclosure system.?That hundreds of thousands of shadow inventory homes still working its way to the market.

? ? Many market participants long claimed the government ? including Fannie, Freddie Mac and the Department of Housing and Urban Development ? are deliberately holding these homes off the market in order to get more for them when home prices recover.

? ?Why is that important? Because Congress has finally gotten serious about winding down the GSE's.

?In a move that virtually ends any hope that Freddie Mac and Fannie Mae will return to viability, the Department of the Treasury and the Federal Housing Finance Agency (FHFA) have revised the Preferred Stock Purchase Agreement (PSPA) between Treasury and the two government sponsored enterprises (GSEs). ? The new agreement will strip the GSEs of any profit from their operations and will accelerate the rate at which they are reducing their owned loan portfolios.?During the 2008-2010 period, the GSE's and FHA were the only mortgage providers out there. The major banks had almost completely withdrawn from the market.

? ?(And speaking of FHA, 1 out of 6 FHA loans are delinquent. Which means another multi-billion dollar taxpayer bailout is in our future.)

? ?Going forward, government subsidies for the housing market will be shrunk (but not eliminated). This is putting pressure on the GSE's to unload inventory in the quickest way. This has led them into the arms of hedge funds and private equity firms.

? ? ?Fannie and Freddie are now piloting programs for bulk sales of foreclosed home. Historically, they?ve sold them individually or in geographically dispersed packages, but since February, Fannie has been experimenting with selling homes in large volumes in Phoenix, Atlanta, Chicago, Florida, Los Angeles and Las Vegas. There are also reports of investors making significant buys in Florida. Bank of America is also experimenting with bulk sales. It?s likely that once the Fannie and Freddie programs are up and running, the servicers will copy their template with private label loans.?Yves Smith calls it, a ?rentcropper society.?

[...]

? ? There are several grounds for concern. One is that there is no model for large-scale, absentee landlords of single family homes. In the past, institutional investment in residential rental has been in multifamily properties, often apartment buildings. And these almost without exception had property management in place at the time of acquisition or was in dense urban areas where it was easy to find experienced management firms. And even in locales where those services are available, PE firms have too often proven to be bad landlords by design.

? ?But that isn't the biggest effect windows down the GSE's will have.

Their biggest presence has always been in the secondary-mortgage market. Without them clearing mortgages, it is likely that getting a mortgage will be much more difficult for the less-than-wealthy.

? Personally, I support closing down the GSE's. The housing bubble couldn't have happened without them. But we also have to be realistic about the future of housing. Over the next decade hundreds of thousands of homes will be dumped on the market by the GSE's, while Baby Boomers will be wanting to sell their homes to pay for their retirements, while mortgages will be harder to obtain for young couples.

? ?That is simply the way it is.

Source: http://www.dailykos.com/story/2012/08/23/1123354/-Concerning-the-Great-Housing-Rebound

day light savings daylight saving time 2012 grapes of wrath silent house nfl mock draft project m rubio

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.